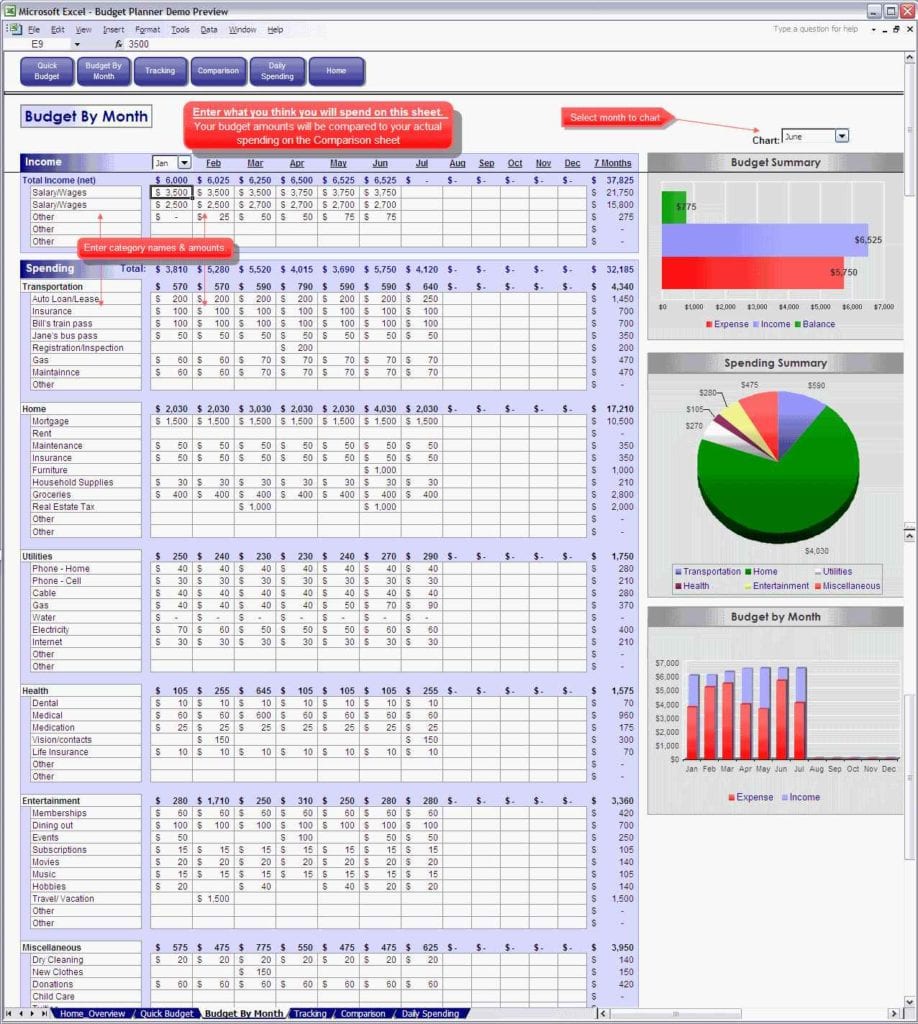

Do you always shop around before renewals?.Are you on the best deals for everything?.No matter what the outcome of your budget planning, whether you have money left over each month or you don’t, in all cases you should be looking to see where you can shave some pounds from your outgoings by asking yourself the following questions: What to do once you’ve completed your monthly budget planner I’d recommend keeping a spending diary (basically a list of EVERYTHING you buy for a month to see what it is that you’re not seeing and then reassess at the end of that month. I bet your food spend is less than in reality is too – if you know you often pop to the shop on the way home from work for a top-up shop but don’t count it as it’s only ever a couple of bits then you should be adding in extra to account for that. The same applies to anything you regularly spend on whether it feels like it should be part of a budget or now. For example, if you buy a coffee every day on your way to work then it’s a regular expenditure so either cut back (take your own) or include it in your budget. If the amount on paper is less than you actually have in reality – that means you’ve either missed some things off, haven’t been completely honest or haven’t counted everything that counts. When it’s all down on paper, it’s a simple case of subtracting your outgoings from the money you have coming in to see how much you have leftover each month. The planner is broken down into sections that should remind you where you might have missed something but it’s well worth sitting down with your last three months worth of bank statements to make sure that you capture everything. Once you’ve decided which version of the monthly budget planner to use, print it out and take some time to complete it making sure that you don’t miss anything from your income or expenditure categories.

#Free budget spreadsheet how to#

How to use your free monthly budget planner

If you want the plain old boring version (:-)) then you can hit this link to go to Google Docs and get that one >ĭon’t forget! If you miss things off then your monthly budget isn’t going to be accurate which could cause problems if you’re spending what you think you have available. So if you want the pretty monthly budget planner version then just click here which will take you to the link to it. The link for that is below if you’d prefer to print out the Google docs version but I’ve also made a prettier version which looks much better when you print it out and it’s definitely my preferred option when I re-do my monthly budget! How to get your free monthly budget planner I first included a printable monthly budget planner on here not long after I started blogging and to this day, I can see that lots of you follow the link to my original version over on Google Docs every single day. I’ve written lots of posts about how important it is to know exactly what your monthly budget because let’s face it, it’s difficult to know where to save money if you don’t know exactly where it’s been spent isn’t it? Filling in all of your income and expenditure on this form (as long as you do it honestly) will help you see where you can save money and where you have a little extra to play with. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt.This free monthly budget planner is just what you need to get your finances in order! There are two versions for you to choose from – a pretty colourful one or a more grown-up serious version with no colour in sight.

#Free budget spreadsheet download#

All you need to do is download the template and plug in a few numbers-the spreadsheet will do all the math. With a template, you get a ready-made spreadsheet with the right formulas to do all of the calculating for you. Technically, these are spreadsheet templates that you can use with Microsoft Excel, OpenOffice Calc, or Google Sheets. One option on this list even walks you through how to choose a debt-payoff method by comparing the snowball method to the avalanche method and other strategies. The snowball method is a popular strategy, and downloading one of these debt-snowball spreadsheets can help you reduce your debt. But spreadsheets simplify the task, making it easy for anyone who can use a spreadsheet to make a plan to pay off debt. Coming up with a plan for paying off debt may sound difficult, especially if you don’t have a financial background.

0 kommentar(er)

0 kommentar(er)